Return on Marketing Investment (ROMI)

Making Powerful Use of a Confusing Metric

What is ROMI?

Measuring the business value of marketing has been a popular if not critical activity within departments for decades now. With the rise of ROI measurement in the 1970s, businesses increasingly sought to quantify different functions in financial terms, sometimes simply for cost-cutting, others for tactical or strategic purposes (implementing an ERP, etc.) As businesses focused on measuring financial returns, marketing held a unique position: the function’s sole purpose is to create value for a market offering. As a result, the imperative to measure business value was clear, both within the function and at the senior leadership level. The use of ROMI, the return on marketing investment, is now widespread, but little consensus exists in the actual methodology.

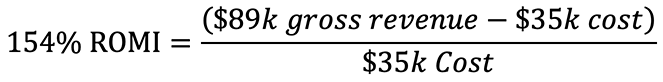

Typically ROMI is the financial value generated by a marketing initiative or set of initiatives, represented by a simple formula:

The intense focus on financial measurement led many marketers to strive for accurate calculations of marketing costs and generated returns. As a result, the financial climate helped spur businesses to increase data analytics expertise, use data-driven decisioning, and ultimately tie more business development activities to revenue and profit. However, because the purpose of ROMI calculations was aligned with cost-cutting and short-term profit measurement, ROMI often became a historical measurement projected over a short-term planning effort.

When marketing evaluation began, the dominant marketing media was one-way: print, television, radio. Measurement was expensive and less informative. Television advertisers used Nielsen’s rating system to provide Gross Rating Points (GRP) to determine the number of people who watched, and from that metric one could divine the Target Rating Points (TRP) calculating the number of viewers that were in the target audience. With the current dominance of online marketing and non-linear television, tracking marketing efforts such as customer interactions and purchases became accessible. ROMI as a function of available data was within everyone’s grasp.

The discipline of ROMI has now been widespread across diverse industries for 20 years, and recent years have seen sophisticated attribution modeling, and strategic marketing output as a result. Instead of widespread standardization of measurement (and accuracy), however, the increase in efforts to calculate ROMI has resulted in numerous competing methods, rendering comparisons between ROMIs unusable, and communications of ROMI value dependent on each marketer’s unspoken assumptions and variable use.

ROMI Applications

Despite inconsistent methodologies and results, ROMI remains popular because of its practical uses. For organizations that view marketing as a cost center that is subjectively related to revenue, ROMI at least provides justification for funding the department. For those that value marketing as an integrated, strategic part of the business model, ROMI can inform strategic and tactical decisions. This disparity in purpose drives a wide-range of ROMI applications.

- Annual marketing budgeting: Marketing costs are a clear, visible, and immediate expense, brought higher by the actual cost of media spends (television, print, online advertising); as a result, validating impact helps justify a function that leadership doesn’t completely understand.

- Selecting marketing initiatives: Choosing which marketing initiative to start, continue, or stop serves a practical and financial purpose. Comparisons can be made of marketing returns for different products, target markets, and media; At the campaign or campaign component level, such calculations can determine the most effective element to continue expenditures.

- Competitive benchmarking: Evaluating marketing efforts against competition or a research-derived standard serves as internal guidance for marketing efficiency and targeting; while competitors’ ROMI may not be directly accessible, approximations can be made from market research and deduction from public information.

- Historical projections: Calculating past returns for similar initiatives can provide predictive value informing the spend levels of future campaigns.

- Tactical business decisions: Using ROMI to measure different tactics that impact business outcomes. Today, the ROMI can effectively be used strategically, defining which marketing tactics to use, where to use them, how to approach different target markets, etc.

- Strategic business decisions: Evaluation of different marketing elements in conjunction with other data sources (CRM, CDP, Google Analytics) can lead to insights for customer targeting, effectively identifying strong and weak target markets; insights on product lines that contribute to decisions about new offering development; and ultimately point to new value propositions as market response changes due to saturation.

The Marketing CRM

The marketing-focused CRM captures every interaction, preference, history of the customer analyzes volumes of historical ...

ROMI in Practice

While the variety of uses could be expected to drive different ROMI calculation assumptions, the range of meanings used by different businesses expands beyond even these. Different purposes, limited data or data analytics expertise, and pressure from stakeholders–all drive the disparity of ROMI approaches and results.

Total Spend and Return Measurement

At its most reductive, ROMI has represented the ratio of all revenue to all marketing costs. For this use of ROMI, practitioners have identified standards for a good ratio (5:1), an excellent ratio (10:1), and a poor ratio (2:1). Because the metric is comparing total revenue–not profit–the ratio must be high enough to account for COGS and typical margin ranges.

On the simplistic end of ROMI measurement, some firms attempt to calculate the total value of marketing efforts by comparing the total annual marketing spend against total revenue. For example, the formula below captures a global marketing return cost, although the unspoken assumptions are numerous and obvious.

Similarly, firms have used annualized financials to compare the customer acquisition cost (CAC) with an annualized customer life-time value (LTV). Simplifying CAC as the total annual marketing spend divided by the number of new customers in the same year. A simplified LTV can be calculated by comparing average transaction size and repeat customer rate. If the predicted average LTV is $400, and the CAC is $40, the ROMI is 10 times the spend.

Specific Marketing Initiative Measurement

While a common approach, calculating ROMI for a specific marketing campaign can still produce varied results depending on the assumptions used. A firm runs an integrated campaign using email marketing, content marketing, and social media. Total marketing cost is $100,000, net unit profit is $750. By using a control group baseline, the analyst determined that 300 additional units were sold to the marketed group. As a result, the ROMI is 125%.

A firm runs a campaign based solely on content marketing using a $70k video series across multiple platforms. At least one of the videos was viewed by 8000 unique visitors; however, the leads generated are not tied back to videos. Instead, based on historical data from similar campaigns, 25% of viewers will become qualified leads within 8 weeks, and 15% of these leads will convert to a sale within a year, projecting 2000 qualified leads, 300 sales, $1200 net unit profit, total $360k.

An online luxury tea retailer runs a 90-day integrated digital campaign with display advertising on topic-targeted websites and search advertising promoting specialty imported loose tea. All components tracked attribution, total gross revenue was $89k, total advertising spend was $35k. The ROMI value in revenue was 154%.

A national jewelry chain conducts a year-long multi-faceted campaign, including television ads for major markets, online search advertising geo-targeted for each retail location, social media for brand awareness, and direct mail flyers in local markets. Gross profit for the year was $45M. Total campaign advertising cost was $12M. Because large-value purchase items entail a longer customer journey than near-commodities, the total return on marketing was expected to continue three months after the campaign ended. The company used an established sales baseline to determine that 55% or $25M of the annual gross profit was attributable to the campaign.

However, the company had another goal for measuring the value of the marketing effort: They needed to know the efficacy of the campaign components in order to create the following year’s business and marketing strategy. For online advertising, the campaign used multi-touch attribution modeling based on historical customer journeys. For television and print, however, the company experimented with varied frequency of delivery in different regions, evaluating website and retail contacts following different saturation levels. Drawing on this data from online and traditional marketing, the company performed regression analysis to understand the effectiveness of different exposure combinations.

Managing the Digital Advertising Ecosystem to Create Value

The Digital Advertising Ecosystem Digital advertising is the delivery of promotional materials through various online ...

The Ramifications of Variability

Like much of the business world, all the examples above use the basic ROMI formula, and their results are decidedly dissimilar. Assumptions underpin each calculation, with different values for marketing cost, return on marketing, and even the type of value ultimately expressed. Each practitioner likely has a different reason for performing the calculation–justifying a budget, determining which marketing initiative to continue, or gathering information to evaluate a target market or product attribute.

Inside the ROMI Calculation

Despite the variability of uses and assumptions within ROMI, a clear, consistent application is feasible if businesses understand the values represented by each variable and driver within the ROMI formula.

Getting the most value from ROMI calculations requires articulating a clear purpose for using ROMI, understanding the possible values of the calculation’s variables, and selecting values that align with business goals. Determining total ROMI to develop a department budget may be less complex than using marketing valuations for strategic decision-making, but both require an intentional use of the corresponding and relevant variable values. Below are the main formula variables, along with the most common values.

Main Variables and Definitions

Value Generated by Marketing (Valuation methods of returns): Defining the type or method of valuation being computed as a result of the marketing evaluation.

- Revenue: measuring marketing performance against gross revenue. When the margins are unknown, this metric can still be useful if comparing two marketing initiatives using revenue as the return value for both.

- Profit: measuring marketing performance against gross or net profit. Ideally more powerful than revenue comparisons, as the business goal is likely more profit-driven than revenue-driven.

- Baseline lift: comparing total value with what would have happened without the marketing initiative being evaluated. Establishing a sales baseline is useful when sales are not directly attributable to specific marketing initiatives.

- Comparable cost: measuring cost savings or differences when a financial value is not directly unmeasurable, or measuring non-financial soft metrics.

- Funnel conversions: measures projected sales based on historical conversion rates. Projected conversions are useful when the sales return is unknown (e.g., sales representatives do not tie their successes back to lead sources).

- Customer equity: measures outcomes impacting customer value (more challenging to measure), and the financial value is not immediately ascertainable.

- Marketing assets: measures the change in brand or business market value.

Cost of Marketing (Scope of marketing spending): Selecting which part of marketing to measure, and how these marketing costs are tallied.

- Scope of marketing activities to include:

- Micro-initiative: a specific singular marketing initiative

- Large integrated initiative: e.g., multi-channel, multi-year, digital, and traditional

- Complete marketing mix: comprehensive marketing effort, including interactions and influences between different marketing elements, carryover effects from different durations of influence, all types of media

- Scope of marketing costs (inherent and related) to include:

- Internal resource costs: the staff cost to develop creative components, deploy marketing to channels, etc.

- Technology costs: analytics platforms, video/graphic editing tools, etc.

- Media and channel deployment cost: the cost of actual spends to place messaging in different channels and platforms

- Comprehensive costs contributing to marketing: varied promotional costs (pre-campaign market research, logo/packaging design, cooperative advertising incentives, all media spends

ROMI Range of Spending (response curve level): The type of return value being defined.

- Total return: return of all marketing spending; evaluates return of all marketing spending

- Incremental return: evaluates the return for a specified additional spending increment (of a particular marketing initiative)

- Marginal return: evaluates the return on the “last dollar spent” on marketing, determining what the additional unit of marketing spending would return, the curve that represents the diminishing returns, and can guide decisions on future spends on the targeted marketing initiative; measures the expected additional revenue earned for each additional unit of M spend

Additional Drivers

- Attribution: Attributing sale to the right marketing touch point, returns that require multiple touch points; A/B testing can be effective in determining impact of a limited marketing initiative; however, even using these two data points discounts the non-linear response that functions on a range with far more data points.

- Marketing Complexity: calculating the interconnected influences within a complex marketing mix, and the resulting way clusters of disparate components impact sales differently than when used singly.

- Time period: Defining duration of evaluated marketing initiative and the timeframe of returns. Effects of marketing are often delayed well beyond the end of a marketing campaign.

- Established sales baseline: defining the expected return value without marketing; useful when defining marketing impact without clear attribution ability

- Limited data/analytics: necessary data to define ROMI for a specific goal or component is unavailable, or the data analytics talent required to calculate is unavailable. As a result, marketers use assumptions, calculate at a suboptimal level, or use projected values based on historical data.

Each combination of variable values and drivers creates fundamentally different measured returns, and each combination can have radically different levels of computation complexity.

Creating a Working ROMI Model

Given the abundant variable and driver values, how can a business develop a working ROMI model that best aligns with goal and strategy? Getting an accurate and relevant value from ROMI calculations requires deliberate intention when making model choices. A marketer must articulate a clear purpose for using ROMI, select the most relevant values of the calculation’s variables, and calculate ROMI component values as accurately as possible.

Defining the Goal

The goal in ROMI is more than defining the value of marketing. The goal is for what purpose is the ROMI calculated. The objective of marketing is not to maximize ROMI, but to maximize profit and expand the business. Defining the specific goal for calculating the marketing value drives ROMI model choices. The goal can be to justify overall marketing expenditures to the leadership team. Or the goal may be to help evaluate potential product attribute modifications. Or it may be to compare the relative impact between campaigns in order to allocate funds to the most effective. Each case requires a different set of ROMI formula values.

Selecting Variable Values

Measurement staff must select variable values and calculation methods that provide an evaluation that responds to the business goal. With a clarified goal, the team can more easily select relevant variable choices that solve ROMI for a specific business context.

To justify marketing spending to internal leadership, using a ratio calculation or a total spend/revenue model may suffice for the immediate goal: informing leadership of a positive return. However, as a stakeholder in the business, the CMO or lead analyst should determine methods to provide more value than a binary positive or negative value.

However, if the goal is to help evaluate possible product attribute modifications, marketing effort and measurement variables are chosen to facilitate this goal. A multi-market campaign with different attribute messages per location can be measured using separate attribution for each region, or A/B testing between regions. For example, comparing response levels to different product attribute messaging in different geographic markets. Either revenue, profit, or conversions would all support the goal since the comparison is between response levels of different messages.

A goal to grow market share while increasing CAC efficiency might use a complex attribution model to measure return at all touchpoints. With statistical modeling assigning values to each point in the customer journey, marketing components could be aligned to provide the most effective support at each step.

Calculating ROMI Components

Once the goal definition and relevant variable values are selected, each variable must be calculated with precision. The further removed from actual values (e.g., using unvalidated historical projections), the less likely the resulting return valuation will be relevant for the ROMI goal. If an organization has limited technical or analytics capability, selecting a partner can help with the immediate need and help build internal capabilities.

Moving Forward

ROMI is an effective metric when approached with diligence and intent. ROMI is as accurate as the degree of input definition, the calculations used for creating each input, and the overall alignment with the situational business goal of the metric. The value and utility of measuring different types of returns from diverse marketing initiatives are hard to overstate.

RESPONSES